Dex Adoption Trends – What’s Driving the Growth of Decentralized Exchanges in 2025?

Decentralized Exchanges (DEXs) are quickly becoming a cornerstone of the crypto ecosystem. Unlike centralized exchanges (CEXs), which operate through a third party, DEXs enable peer-to-peer trading directly on the blockchain. As we step into 2025, DEX platforms are not only reshaping how people trade cryptocurrencies but are also redefining trust, security, and autonomy in finance.

This article takes a deep dive into the current DEX adoption trends, backed by fresh data, regional insights, and projections for the future.

📊 What is Driving the Growth of DEXs?

Several dynamic factors are contributing to the increasing adoption of DEX platforms globally. Here’s a look at the most impactful drivers:

1. Decentralization and Autonomy

Users are becoming more aware of the importance of custody over their own assets. DEXs empower traders to retain control of their funds by eliminating intermediaries. This shift aligns with the core principle of cryptocurrency: financial sovereignty.

2. Increased Transparency and Security

All transactions on DEXs are recorded on a public blockchain, making them fully transparent and traceable. Unlike centralized exchanges, which are susceptible to hacks and insider risks, DEXs offer greater resilience through smart contract execution and community governance.

3. Innovation in Blockchain Infrastructure

Blockchain ecosystems like Ethereum, Solana, and Arbitrum have significantly upgraded their infrastructure to handle higher throughput and lower gas fees. These enhancements are making DEXs faster, cheaper, and more scalable than ever before.

🌐 Geographic Highlights of DEX Growth

🌏 India Leads in Adoption

Despite regulatory uncertainties, India continues to rank as the top country in terms of crypto usage. A significant portion of this adoption includes decentralized platforms, especially for staking, trading, and yield farming.

🌍 Emerging Markets Fueling the Growth

Latin America, Southeast Asia, and parts of Africa are also seeing increased DEX usage. Limited access to traditional banking in many of these regions makes DEXs a more inclusive option for financial participation.

🔥 Top DEX Platforms Dominating the Market

According to recent data:

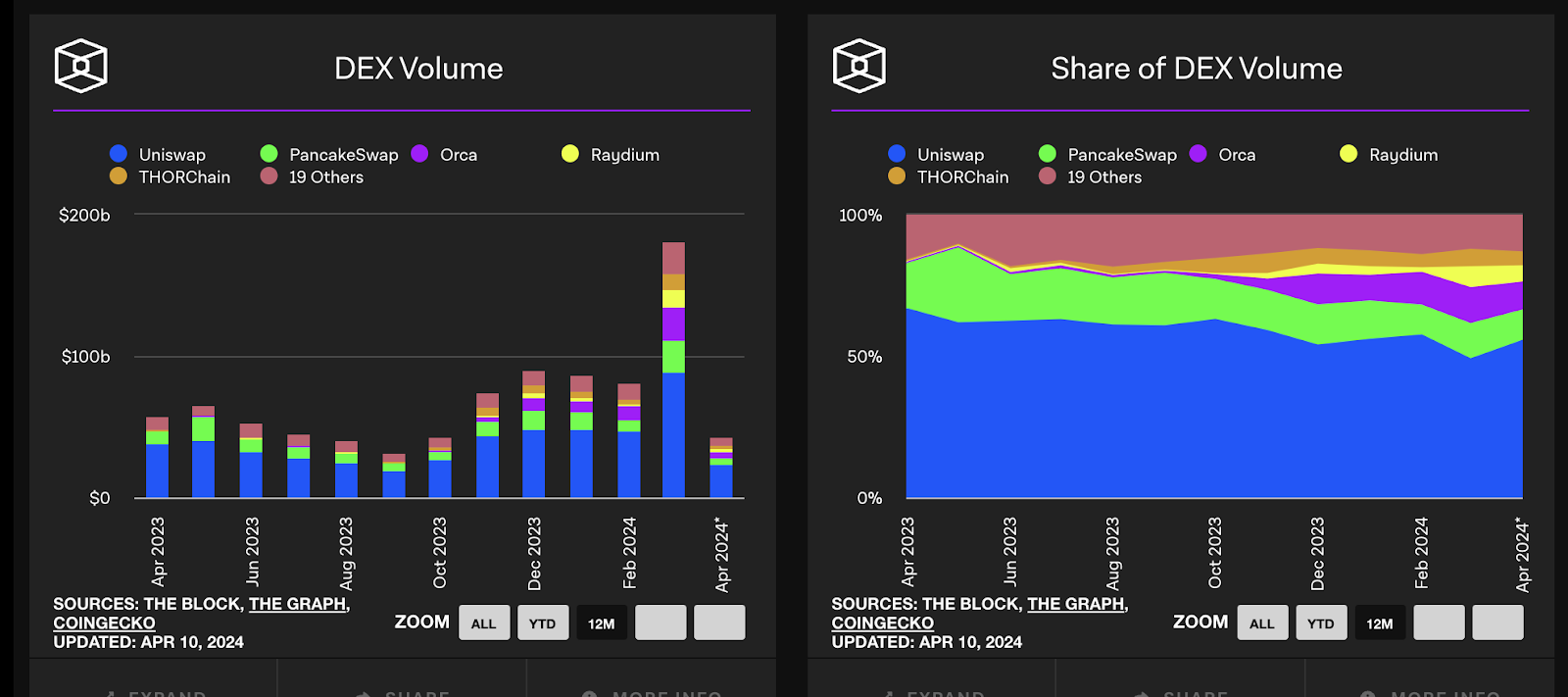

- Uniswap holds the largest market share with over 50% of the total DEX volume.

- PancakeSwap, Curve Finance, Balancer, and dYdX are also witnessing strong performance, especially in the DeFi derivatives sector.

- Hyperliquid and other emerging derivatives DEXs are gaining momentum due to the rise in perpetual futures trading.

📈 Statistics That Show the Rise

- ✅ In Q2 2024, DEX spot trading reached $370.7 billion, up 15.7% from the previous quarter.

- ✅ Derivatives DEXs reported a 26.5% monthly increase, culminating in $285 billion in volume by year-end.

- ✅ Solana-based DEXs reached an all-time high of $129 billion in monthly volume, overtaking Ethereum’s peak figures.

These numbers point to an undeniable trend: decentralized trading is no longer an alternative — it’s becoming the norm.

⚙️ Technical Advancements in DEXs

💡 Cross-Chain Swaps

Protocols now enable seamless cross-chain trading without relying on bridges, which were previously security bottlenecks. This opens up trading possibilities across various blockchain ecosystems in a unified manner.

🤖 Integration of AI & Bots

New DEX platforms are incorporating AI to offer automated trading strategies and better liquidity management, enhancing user experience for both beginners and professionals.

📱 Mobile DEX Solutions

Mobile-first decentralized wallets now include in-app DEXs, bringing seamless token swapping, liquidity provision, and staking directly to smartphones.

💼 Institutions and DeFi: A New Era

One of the most interesting DEX adoption trends is the entry of institutional players:

- Banks and Hedge Funds are exploring private DEX pools to facilitate large trades without slippage.

- Regulated DeFi products are being created to meet compliance standards, giving institutions a safe entry point into decentralized finance.

This professional layer is a key step toward mainstreaming DEX usage across traditional finance.

🛡️ Decentralized Insurance and Risk Management

One of the barriers to DEX adoption was the lack of protection against smart contract failures. That is now changing with:

- Decentralized insurance providers like Nexus Mutual and Bridge Mutual offering on-chain coverage.

- Auditing protocols using AI to constantly scan smart contracts for vulnerabilities.

These measures are instilling greater confidence among users and investors.

🚀 What’s Next for DEXs?

🔮 Predictions for 2025 and Beyond

- DEX/CEX Convergence: Expect more CEXs to launch hybrid DEX models.

- RegTech Integration: Decentralized ID and KYC solutions will help DEXs comply with regional laws without compromising privacy.

- Tokenized Real-World Assets: Integration of real estate, bonds, and commodities into DEXs will further widen their use case.

FAQ’s

1. What is a Decentralized Exchange (DEX)?

A Decentralized Exchange (DEX) is a peer-to-peer platform that allows users to trade cryptocurrencies directly with each other, without the need for an intermediary like a centralized exchange (CEX). Trades on a DEX occur via smart contracts on a blockchain, offering increased privacy and security.

2. Why is the adoption of DEXs increasing in 2025?

The adoption of DEXs is rising due to factors like enhanced security, user autonomy, better transparency, and technological advancements in blockchain infrastructure. As users become more aware of the risks associated with centralized exchanges, DEXs provide a safer, decentralized alternative for trading cryptocurrencies.

3. What are the most popular DEX platforms in 2025?

As of 2025, some of the most popular DEX platforms include Uniswap, PancakeSwap, Curve Finance, dYdX, and SushiSwap. These platforms lead the market in terms of trading volume, liquidity, and innovative features such as automated market making (AMM) and decentralized finance (DeFi) solutions.

4. How do DEXs ensure better security than centralized exchanges?

DEXs offer better security by allowing users to retain control of their funds. Unlike centralized exchanges, where users entrust their assets to third parties, DEXs operate on decentralized protocols where users trade directly from their wallets. Additionally, DEXs are less vulnerable to hacks and internal threats since no central authority controls the platform.

5. Can institutional investors use DEXs?

Yes, institutional investors are increasingly entering the DEX space. Many DEXs have developed features and private liquidity pools to cater to institutional needs, such as high-volume trades and compliance with regulatory standards. The integration of advanced trading tools, like automated market makers (AMMs), also appeals to institutional traders.

6. How is the future of DEXs shaping up in the next 5 years?

In the next 5 years, DEXs are expected to grow significantly, driven by the adoption of cross-chain swaps, the integration of DeFi products into traditional finance, and the development of scalable blockchain infrastructure. Furthermore, DEXs will likely play a major role in the tokenization of real-world assets, expanding their use cases beyond cryptocurrency trading.

Conclusion

The rapid evolution and adoption of DEXs point to a decentralized financial future that is more accessible, secure, and autonomous. From record-breaking volumes to widespread global use, the momentum behind DEXs is stronger than ever in 2025. If you’re a trader, investor, developer, or simply a blockchain enthusiast, keeping up with DEX adoption trends will be key to navigating the next wave of innovation in crypto finance.